Property Development: The Rapid Road to Wealth

I’m often asked the question, particularly from non-property people, how profitable is property development?

Well, it largely comes down to risk versus reward. This risk and return paradigm is well understood by many investors – if you want a higher level of return, you need to accept a higher level of risk, and vice versa.

It’s exactly this paradigm that makes property development such an accelerated road to wealth.

However, with the high potential returns offered, it should come as no surprise the risks can also be significant. I’ve outlined some of the main ones in this blog, and how you can mitigate those risks.

As a property developer, you buy properties or development sites at raw cost (wholesale) price, develop them into multiple dwellings, and then sell the new properties at retail price, making maximum profit in the process. Compare this to traditional property investors, who buy at retail price. slowly build a property portfolio, and wait years for the market to grow.

For me, property development starts with a two-lot subdivision. In this case, we aren’t just adding value to what is already there; we are creating more: ie, one lot becomes two lots.

So how much could you potentially make from a one into two lot subdivision? The big variation is location, which has a large effect on pricing. A two-lot subdivision in Sydney’s affluent Potts Point is going to be worth far more than a two-lot subdivision in Birdsville, in outback Queensland.

Also, the industry standard profit margin for small projects is lower than for larger projects. This margin is calculated as the profit, as a percentage of the total costs.

The margin on a four-townhouse project might become acceptable from 18% – 20% upwards, but on a two-lot subdivision, it might sit around 12% – 14% upwards.

The reason is that the smaller project is quicker to develop, with less financial risk. On the small project, it might be considerably faster to get a development approval, and the only construction could be as little as connecting new services. Also, borrowings are less in dollar terms and cheaper finance is available.

The big variation is location, which has a large effect on pricing.

With the larger project, the development approval typically takes longer, the construction takes longer, the financial risk is higher, and finance is more expensive.

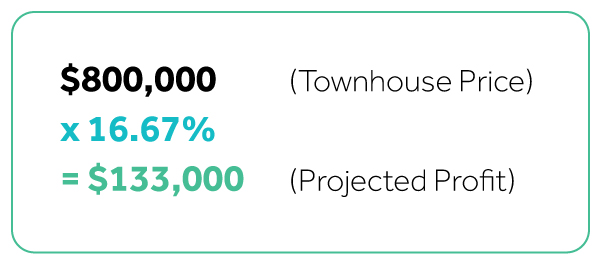

Here is a quick thumb rule for calculating the projected profit on a project showing a 20% margin on cost. If you know what the product (lot, townhouse or apartment) would sell for, multiply that selling price by 16.67%. For example, a townhouse that would sell for $800,000 should show a development profit of $133,000.

When you consider that you can gear the borrowings 4 times (25% equity, 75% debt), that gives you an 80% return on funds invested. It’s not hard to see why property development reigns supreme in the wealth creation property world.