5 Fears That Financially Hold Us Back

New year, new goals, new you… but what if you’ve spent 2019 procrastinating about buying property when that was your last new year’s resolution?

If you’re forever finding a reason why now is not the right time to buy, it could well be your mindset that’s holding you back. The sad reality is that most Australians hit retirement and find they don’t have enough money to fund the life they’d hoped for. And a lot of that is due to the fact they left it too late to start planning their long-term financial future. Don’t let that be you.

Start the new year with a firm plan to make 2020 the year you kickstart your road to wealth, whether that’s buying your first property or building on what you have. The end game is to have a healthy portfolio of properties that will fund a carefree, secure retirement, as I wrote about in this previous blog.

If something’s been holding you back, let’s look at 5 key fears that I’ve identified as obstacles to financial success.

1. Fear of failure

You’ve made your mind up that you want to get on the property ladder, you’ve even cobbled together a deposit and spent endless Saturdays trudging around open for inspections… but that’s as far as you’ve got. If your plan to buy property hasn’t progressed to actually owning one, and a year has ticked by, then it could well be fear that’s holding you back. Fear you’ll buy a dud, get in over your head, lose your job…you’ll never run out of reasons “not to” if you let fear rule your head. Nothing good comes without an element of risk, but remember that risk equals reward, so get on that first rung of the property ladder and start climbing!

2. Fear of timing

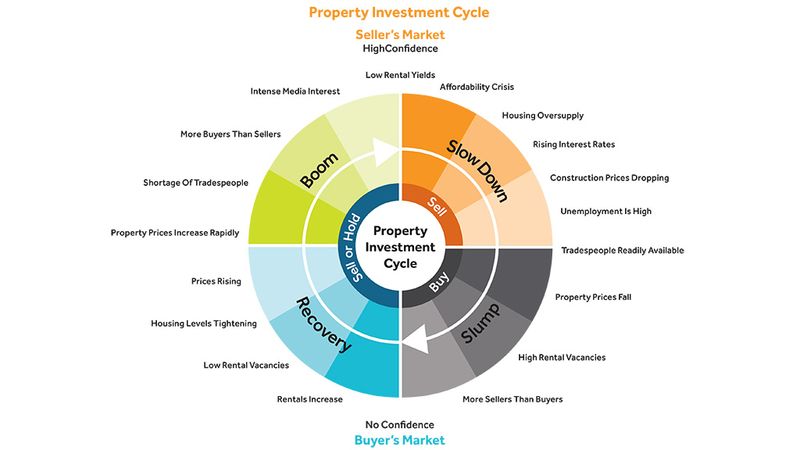

I’ve often talked about the property clock (see diagram below), which basically tracks property over a 7 to 10 year cycle, as it travels through the inevitable peaks and troughs of the property market. Noon marks the peak of the market, 6am is rock bottom – so the ideal is to buy as close to the bottom as possible and sell in a rising market. You’ve hit the jackpot if you sell at the peak. The reality is few people manage to fluke perfect timing, because you’d need a crystal ball to accurately predict what the market is going to do. It’s all about time in the market. If you’ve done your proper due diligence, then it’s always the right time to buy. It’s about knowing where your suburb is at in the cycle.

3. Fear of success

We hear a lot about fear of failure, but fear of success is equally powerful. We all know the impact low self-worth has on relationships and career progression – the feeling you’re unworthy of the person you’re with or the promotion that’s in the wings – well, that same niggling doubt could be standing in the way of you and your first property, and the opportunity to start building the future you deserve. It time’s to get over that mentality! The new you is going to recognise that most people who achieve success have put in the hard yards to earn it and deserve everything that comes their way.

4. Fear of commitment

I’m not talking about tying the knot with your beloved one here, but years of being shackled to a mortgage. Because that’s the reality of being a property investor. Or maybe you’ve got used to the freedom of renting and baulk at the responsibility of owning property. That’s when it’s time to take a long-term perspective and see how the advantages of accumulating property and wealth far outweigh any short-term worries about making a commitment to something.

5. Fear of INEXPERIENCE

That’s where knowledge and education come in. Unfortunately, I’ve seen some people put in more research buying a car, or even a washing machine, than they do a million-dollar property. They line up the finance, go to a couple of inspections, fall in love with a place and buy it. Well, that may or may not work out for you, and if it doesn’t… the financial losses can be devastating. The trick to making money in property (especially a property you’re looking to renovate for profit) is to know what you’re doing. And the only way to know that, is either through experience (the trial and error approach) or learning (let someone else make the expensive mistakes). I know which path I’d recommend.

The Australian Bureau of Statistics estimates that the average life expectancy of an Australian male is 80.5 years and 84.6 years for a female. Research by National Seniors Australia shows that people mostly underestimate how long they’ll live. Those aged 65 underestimate their life expectancy by almost five years and have to face the very real prospect they’ll run out of money before they die.

So where does all that leave you? You can dismiss this blog and continue on your merry way with life as normal. Or, you can make it your new year’s resolution for 2020 to kick those fears to the kerb and start planning NOW for the future you’re worthy of. Happy New Year to you all!

Hi Cherie. We built a new house last year after renovating and selling our first home which we had for 30 years. We now have a small mortgage and of course not enough super to retire on. We are 60 and thinking of buying an investment property but think maybe we should not risk it at our age. What are your thoughts.

Cheers

Lesa

Hi Lesa,

Thank you for writing to me. I think the biggest issue will be your ability to qualify for a mortgage at your current age. You best bet would be to speak to a mortgage broker first to see if getting finance is an option. If it is, you’ll really need to be very smart about what property you do buy to ensure it covers all costs and delivers a surplus income for you. I hope this helps as a first starting point. Cherie x

Hi Cherie. I just found you tonight after catching a you tube vid on reno tips that impressed me. I’m a mature age fella, zero assets (aside from enthusiasm and willingness to learn and take action), gypsy musician who is late to the table. But here i am. I reckon i can do my first deal by years end. Going for it. Happy new year to you and all. thanks, Greg

That’s awesome Greg. Never too late to start anything! My oldest student is 87 years old so it sounds like you have plenty of time ahead of you. C x