How important is the property cycle for investors?

With market conditions in a state of flux across Australia, it’s timely to take a look at what exactly we mean by the property cycle, or “property clock” as it’s otherwise known.

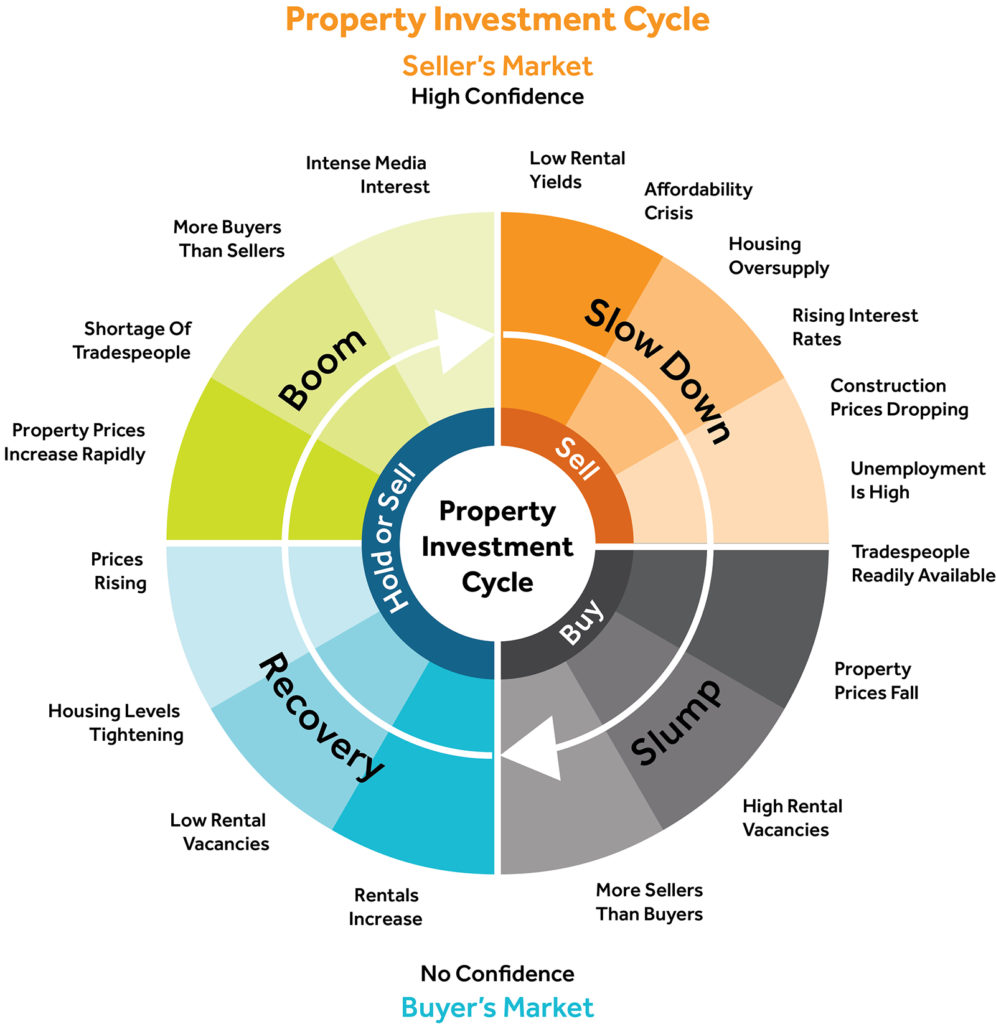

In a nutshell, it’s the theory that every property market eventually does a full revolution of the clock (see below), and that if you hold a property long enough (say, 7 to 10 years) that it will experience the inevitable market highs and slumps that will occur during that time. It’s why it is often said that time in the market is more important than timing the market, because you’ll eventually benefit from an upswing.

Trying to time the market can be notoriously tricky for an investor. The risk is that you end up sitting on your hands so long waiting for the right moment that you miss the boat entirely. Imagine if five years ago you were thinking about buying a Sydney property but decided you’d wait, just in case prices dropped? You’d be feeling pretty foolish now.

However, if you’re one of the hundreds of buyers who purchased in Frankston, Victoria, five years ago, you’d be looking at roughly an 80% increase on your investment by now. And many of those purchasers made that decision to buy because they’d studied the infrastructure changes taking place (like the opening of the direct Peninsula Link to the CBD in early 2013 and major upgrades to the suburb), and figured prices were about to go north.

Now there’s a knock-on effect and all the surrounding suburbs are benefiting from capital growth spurts. Eventually, however, the pendulum will swing and prices will level off, much like we’re seeing in areas of Sydney now, post-boom. In July, the city posted its biggest decline in values since 2009. The Perth market, by comparison, looks like it might have bottomed out and is finally on the way up.

So can you see the property clock in action? They say the property cycle does a rotation every seven to 10 years, and goes through four stages: a boom, slow down, slump and then a recovery.

If you buy the wrong type of property in the wrong location, and/or overpay for that property, the odds are stacked against you right from the start.

I always maintain that 50% of the research and work you do as a renovator should happen before you buy the property. And rather than expending time and energy chasing the perfect time on the clock to buy, you’re better to channel those efforts into the due diligence steps I teach in my Cosmetic Renovations for Profit course. It’s critical you spend sufficient time researching your:

- suburb due diligence (looking at things like capital growth history, infrastructure and whether there’s sufficient pricing disparity between renovated and unrenovated properties)

- pricing due diligence (spending around 12 weeks monitoring what your target properties are selling for so you become an expert on property prices in your chosen suburb/s)

- property due diligence (inspecting the properties you hope to buy with a tick list of must-haves)

That’s your best insurance against fluctuating market conditions. You’ll have studied the market, bought wisely, and manufactured instant equity with your renovation. If there’s a big upswing in the market, then that’s your icing on top. This student case study is a great example of that in action.

Remember, too, there are literally hundreds of micro markets (suburbs, units vs houses, budget vs luxury properties, etc) within any property market (say Sydney or Melbourne). So just because the market as a whole might be in decline or rising, all of those different sub-sectors will be performing at wildly variable levels.

In my 20+ years of renovating, I’ve bought, renovated and sold through every cycle, and always made a profit. So there’s the proof you can make money in any market, as long as you do your research and buy astutely. If you buy the wrong type of property in the wrong location, and/or overpay for that property, the odds are stacked against you right from the start. If market conditions change and you find yourself in a falling market, then you’re doubly vulnerable to losing money.

So the bottom line is: yes, in an ideal world, it would be great to always time your property transactions so you’re buying at close to 6am and selling at close to midnight, but the odds of nailing that every time are pretty random. And the greater risk is that you dither so much you do nothing. A better strategy is to follow all the due diligence steps in my course, and let your research guide you to the best buys and hot spots.

Ultimately, the end game is to buy and hold, building a property portfolio that will buy you financial freedom.