Can you drive more profit with a property partner?

Accelerating property profit is the challenge of both new and seasoned investors – no matter where you choose to invest your time and money.

Whether you’re looking to jump into the property market for the first time, or you’re on your 50th property project, I’ll show you how tapping into pro property tactics like partnerships, joint ventures and small developments is proven to accelerate your return. It’s a tactic you can use with or without being cashed up to start. Would you like to see the equivalent of a 10-year standard residential property return on an 18-24 month property project?

That’s right! A 1.5 to 2 year project with a 10 year ROI.

With no money down?

Let’s discuss how this is possible.

In this article, we’ll cover:

- How the ‘strategic’ property acquirer will always win over the ‘traditional’ residential property investor

- How the number of property deals matter over your lifetime

- Why joint ventures are a key vehicle to drive more property deals and fast track your earnings

- How to assess your potential JV partner

- Free Download: Grader: Score & Identify a potential property Joint Venture partner [NEW]

- Free Calculator: How Much Do You Need To Live & Retire Comfortably? [NEW]

Practice does make perfect:

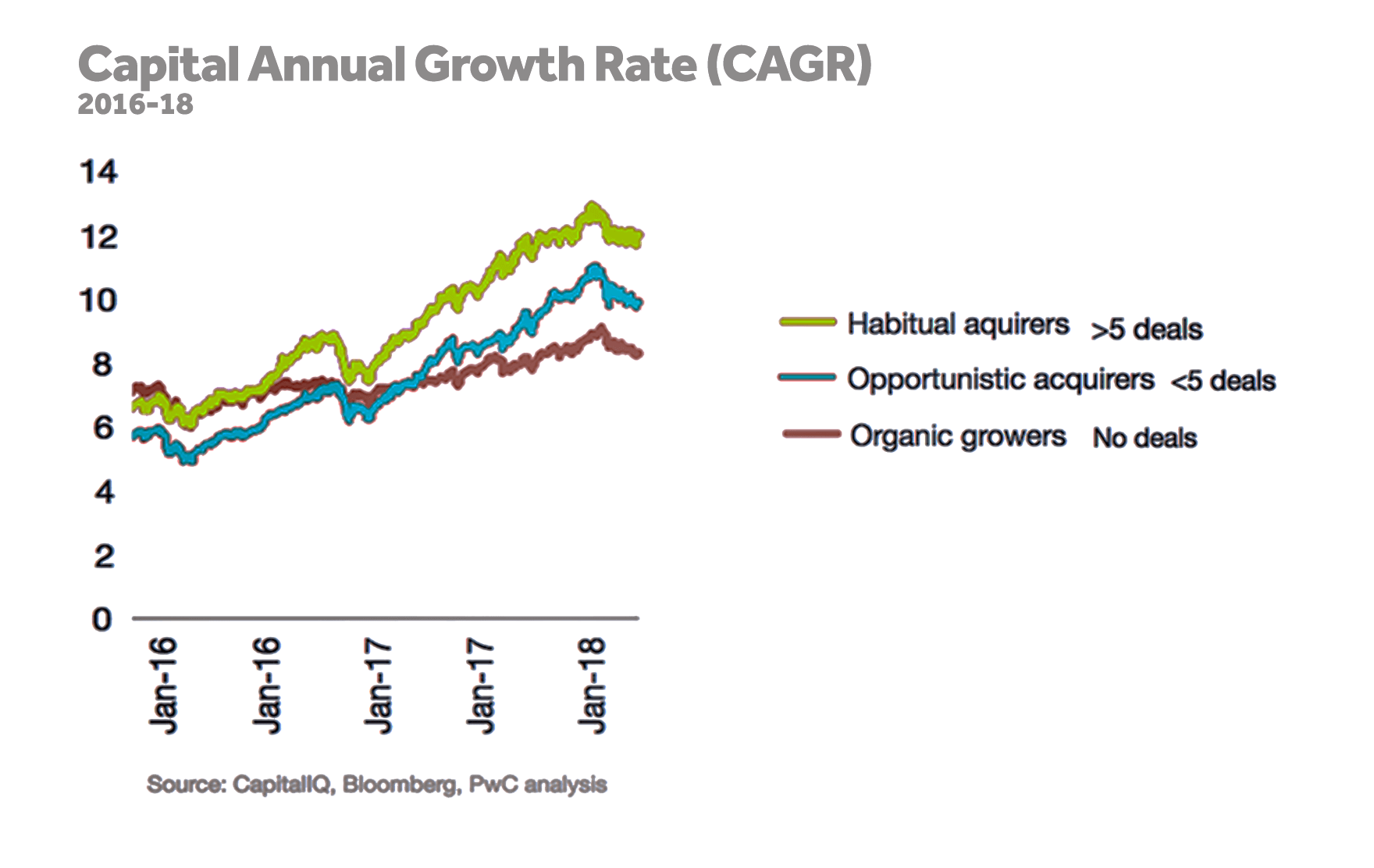

An active property investor (5+ deals)

versus the standard single homeowner

increases their return on the dollar x 2*!

TAKEAWAY: Close more property deals =

faster returns & higher profit results

So many investors know what they want their financial future to look like, but they don’t take the necessary steps to get there. I hear people talk about their anxieties and ‘justifications’ for their slow progress, or current (lack of ) property deals. One of the biggest ‘reasons’ is a dependency on the capital growth of their existing property (waiting for the market to rise before buying again), or investors might be living a frugal lifestyle for a number of years to ‘save for a deposit’. Essentially placing their lifestyle on hold for years waiting for that next affordable property gem. Well …

This will not provide you with true financial freedom.

Questions to ask yourself if you weigh the pace of your property investments:

– How important is it to accelerate a financially free lifestyle for your loved ones? For your partner, your children’s future, your parents, siblings, friends and more?

– How important is it to accelerate the lifestyle improvements you personally want? Are you tired of the limitations and ‘sacrifices’ you’re making to meet your next milestone?

– At what speed do you really want either of the above goals to be met?

1. Be a deal maker. Consistently.

KEY: A large property success factor is based on the number of deals you’re willing to turn over.

What type of investor are you? Put simply, those who invest and acquire more deals over time – particularly in the real estate sector – see a greater ROI on their dollar.

Types of investors by NUMBER OF dealS:

- (i) Habitual investors: 5+ deals (BEST)

- (ii) Opportunistic investors: <5 deals (BETTER)

- (iii) Organic/standard investors: market standard

2. Short and long-term property deal goals. Why?

KEY: Calculate your weekly or monthly income as a retirement goal. Use this as the foundation to forecast the ideal number of property project deals you’ll need.

Whether you want to travel the world in style, quit the cubicle, provide your kids with the best school money can buy, or you’re aiming for a private jet, you’ll inevitably need specific target income numbers. From this, we can work backwards to set your property deal strategy.

A recent UNSW study, “A Matter of Time: Why Some People Plan for Retirement and Others Do Not”, explored time perspective (TP) as a predictor of retirement planning and the consequences. ‘Time Perspective’ (TP) is defined in psychology as a “the totality of the individual’s views of his psychological future and psychological past existing at a given time”. In this study, up to 93% of people demonstrated ‘Time Perspective’ as a trait rather than a state. i.e. a psychological pattern of behaviour, thought, and emotion. Those with a positive time perspective had strong 1-5 year plans and strong retirement planning behaviours, in particular, financial planning. Those with negative time perceptions generally lacked financial fitness and did not plan.

Put simply, if you understand that your clock is ticking, take a positive approach to retirement and start planning now, you’ll set yourself up for a financially free and happy retirement. Put your head in the sand, or take a doom and gloom approach to getting older and you’ll forget to plan, which is an inevitable plan to fail.

TAKEAWAY: How you perceive time = how well you will live and retire.

Use the calculator below to determine your ideal retirement income for yourself, your lifestyle and your loved ones.

3. About Partners & Joint Ventures. Should you bother?

KEY: Trusted partnerships and Joint Venture (JV) deals can truly accelerate your property profit – with the right due diligence.

All too often people refrain from moving ahead with property deals because they think they need to do it alone or need to wait until they have enough money in the bank. Or, they’re afraid of the complexity of the deal.

Let’s break this down.

Usually, the #1 factor blocking someone from considering a property deal is their perceived lack of finance …

#2 is finding the ‘right’ deal…

and #3 is having (access to) expert knowledge.

In truth, what the actual #1 problem really is (and always will be) … is having access to the right experts and information. Leading Australian property development expert, Bob Andersen experienced this as a pivot point to his own real estate success. But before we jump into his story, here are a couple of common scenarios that both drive and limit property deals.

- A MONEY PARTNER: What if you could find an investor because you have done your due diligence on a potentially great property that has been on the market for a while?

- A GREAT PROPERTY DEAL: Perhaps you’re the capital investor, and you haven’t moved onto your next deal because you haven’t found your next deal?

- EXPERTS: How about if you’re a trade professional or developer that just needs to find that right site or needs an astute investor?

You could be a mix of deal maker, investor, or trade expert.

Or, like property expert Bob Andersen, you could be a developer. He spotted a great land site but didn’t have the capital to buy the property.

Hear about how leading Small Development expert Bob got started; including how he went from humble beginnings to become a highly successful property developer with over 1 billion dollars worth of development projects under his belt after partnering with an investor on his first deal.

4. What makes a great Joint Venture partner?

KEY: Communication breakdown through the deal process is the most common reason for joint venture failures. Expectation management, transparency and project management are critical at each step in the deal process.

Professional project managers seem to always top the list of my successful students AND they see the greatest profit results. Project managers from IT, Engineering, Medicine, Education, Hospitality Management, and many other non-real estate related industries seem to excel.

And it’s easy to see why! They’re true professionals at recruiting and working with experts in each part of the property development process. They’re skilled at ensuring all stakeholders are aware and accountable for their agreed action on the project timeline.

Whether you’re looking to go into a deal with your partner, a family member, friend, colleague etc. make sure you have set clear goals, expectations and deadlines.

Interested in property development

Well done artlice that. I’ll make sure to use it wisely.